Overview

| Company: | Getsafe |

| Technologies: | Pen & Paper; OmniGraffle; Axure; Sketch |

| Challanges: | Translating a manual and very personal process into a semi-automated and cohesive experience |

| Learnings: | Close collaboration with subject-matter experts; project splitting and scoping; gradual continuous feature enhancement |

Case Study

InsureTech as a sector has the ambitious goal to disrupt the whole insurance industry. According to various analyses, insurances suffer from old, cumbersome systems and antiquated mindsets. This opens the door for innovative concepts and approaches to (r)-evoluzionise the old-established market. But due to this huge potential, finding a place to start is difficult. We constrained ourselves by identifying and defining the millennial generation as our key target group. This market segment usually isn’t biased too much from inherited issues , prejudices and assumptions about the insurance industry. Since the topic isn’t a very appealing one by nature, millennials usually have not considered insurances too much. We were able to start from a clean slate.

Research

We started the project by doing user research with the identified target group. Our goal was to identify prevailing expectations about insurances and how to translate existing models to meet these expectations. I conducted various in-depth user interviews – partly using the “Jobs to be done”-Framework. It enables the innovator to synthesise a task into it’s single steps. These steps can then build the foundation for any further thinking. The results of the interviews revealed one main occurring issue within our target group

Lack of knowledge about the actual insurance need

N.B. To understand this finding better and to set in relation, it’s necessary to understand the german insurance landscape a bit more. In Germany there are insurances for almost everything – from public health care to specific drone-accident liability insurances. And for every insurance there is a myriad of advisors, brokers and companies whose all want their share of the cake. This creates a confusing market with as many opinions and “truths” as there are parties involved. Especially for job-starters and graduates who seek for information and guidance this creates an overwhelming situation.

Concept Development

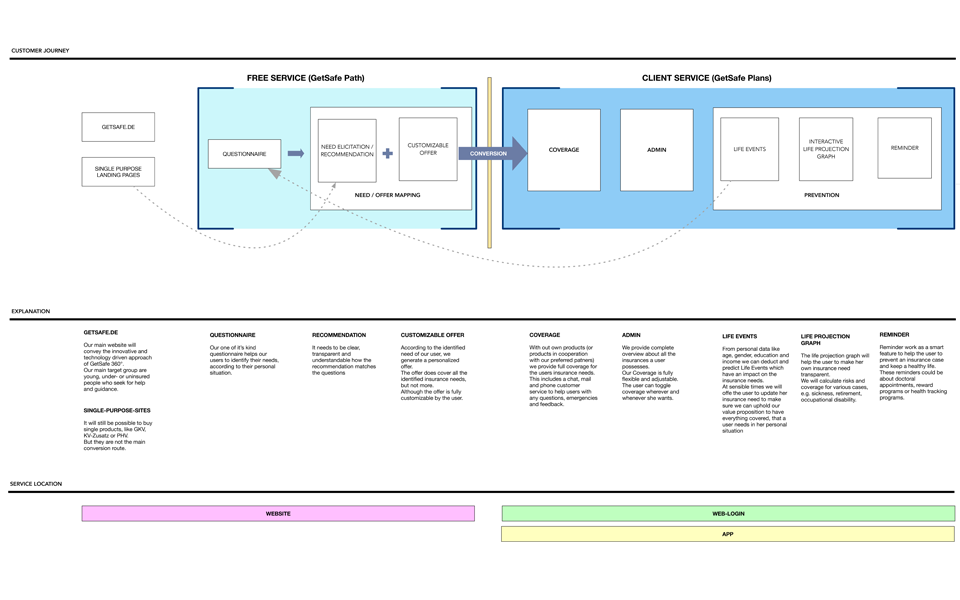

These findings sparked the idea of merging the expertise of insurance specific knowledge, the individuality of a well-informed personal insurance broker and the reliability and objectivity of a robo-advisor into a single service.

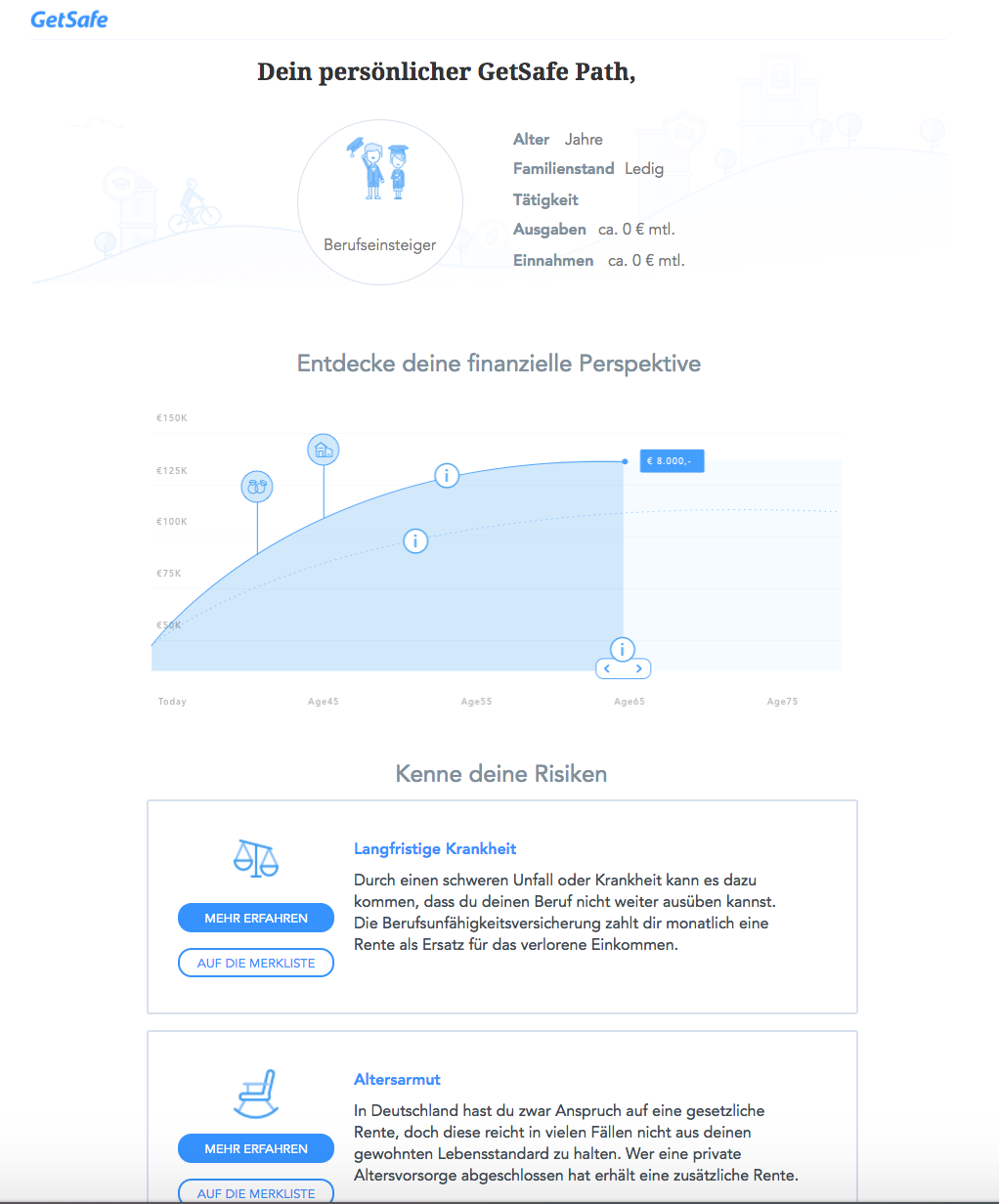

We would ask the user a set of relevant questions to assess it’s personal situation and build a recommendation logic which would provide an individual list of recommended insurances. This service should then serve as the gateway into any further services.

But this idea also raised a couple of different challenges. We needed to translate the individuality and intimacy of a personal consulting dialog into an semi-automated process. The user would need to trust the service and the recommendations it provides and the service itself needed also to integrate seamlessly into the whole customer journey.

Based on these requirements we developed a concept that uses the needs analysis as a lever and acquisition tool, which already provides a lot of value for the user.

This concept depicted the holistic vision of the project. It was intentionally left in a very abstract format, since we anticipated, that the concept will evolve and change over time.

To ensure constant delivery and improvements, we carved out different parts of the customer journey which would make sense as single features. The line of approach was, to have incremental building blocks, where every block would deliver value for a customer in it’s own. Furthermore, we would have the possibility to constantly test and adjust our direction of travel.

Questionnaire Design & Recommendation Logic

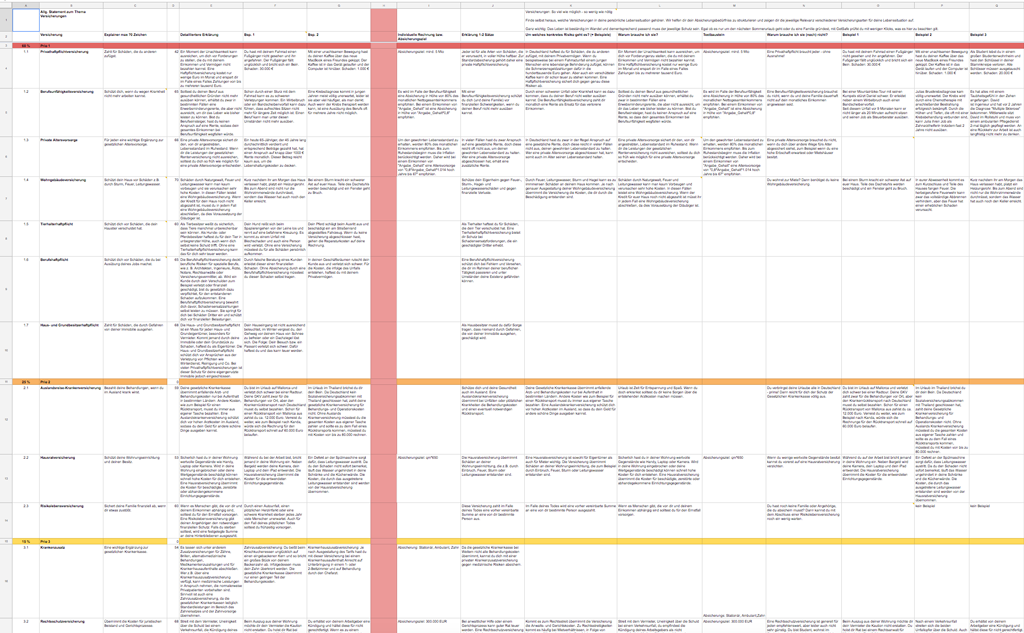

The first step was to build the needs analysis questionnaire, which would be the centerpiece of our service. To ensure the tool would evoke trust and comfort, we worked closely with our insurance subject matter experts. We went through a plethora of advisory conversations, explanation techniques and consulting questions to learn what makes a personal dialog so valuable.

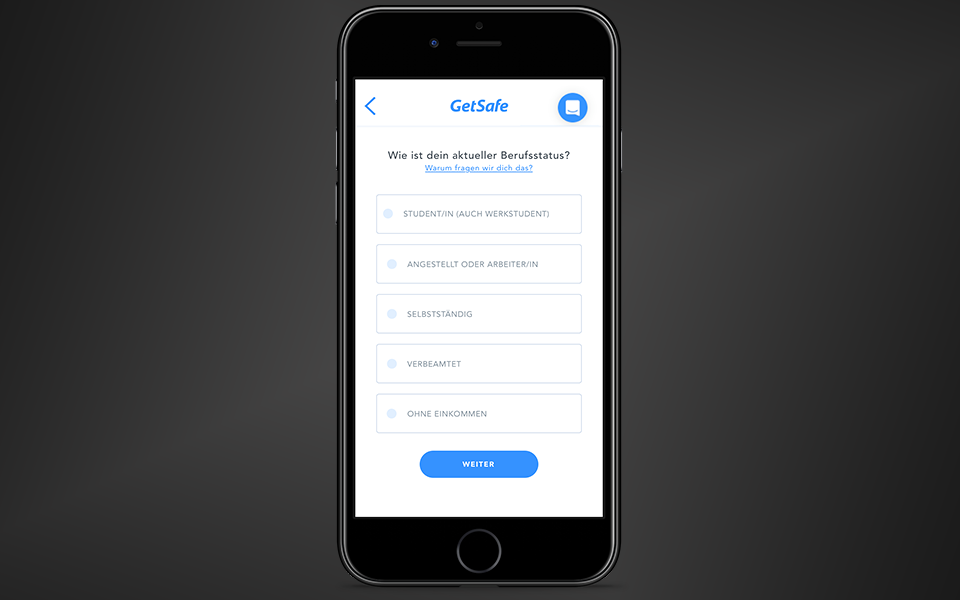

The questionnaire should be easy to use, not taking too much time for the user to complete but still asking all relevant and necessary questions for a decent insurance needs analysis. Therefore we radically challenged every question an advisor would ask whether or not it’s absolutely necessary and helpful. This way we made sure to keep the questionnaire concise but accurate.

Together with our experts, we would also develop a recommendation logic, which would map the given answers from the user to a set of insurances. Every answer had direct effect on the priorities of the insurances.

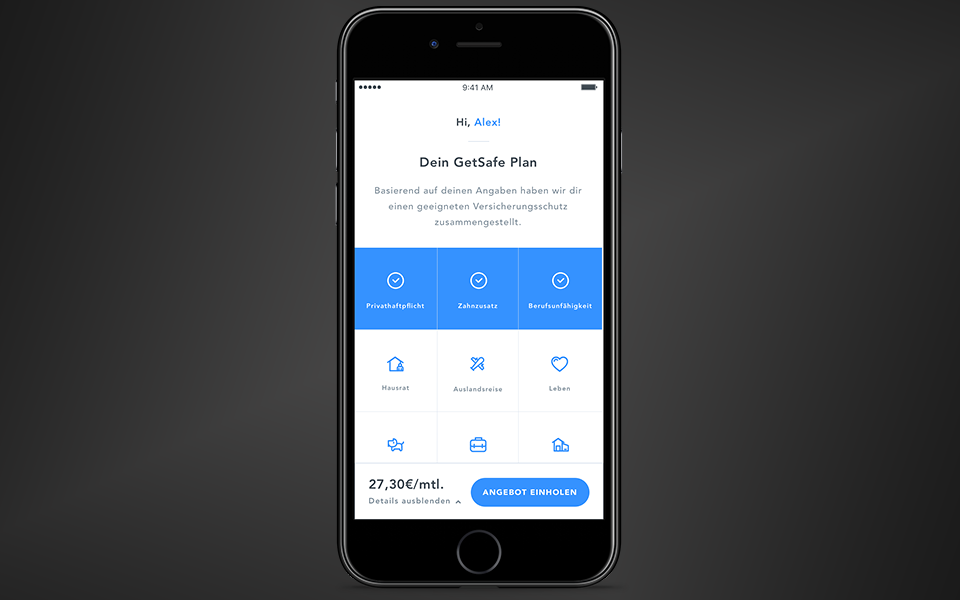

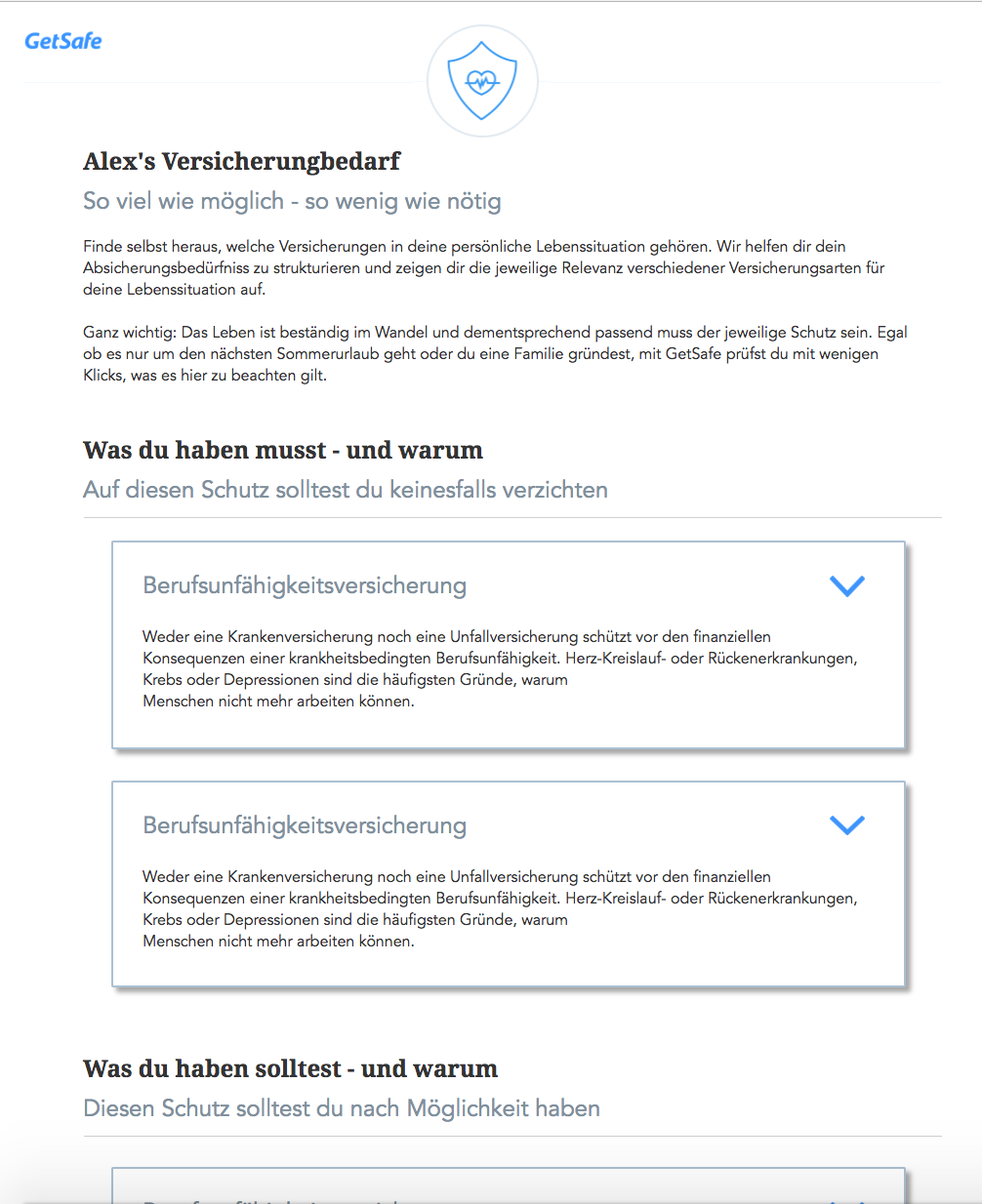

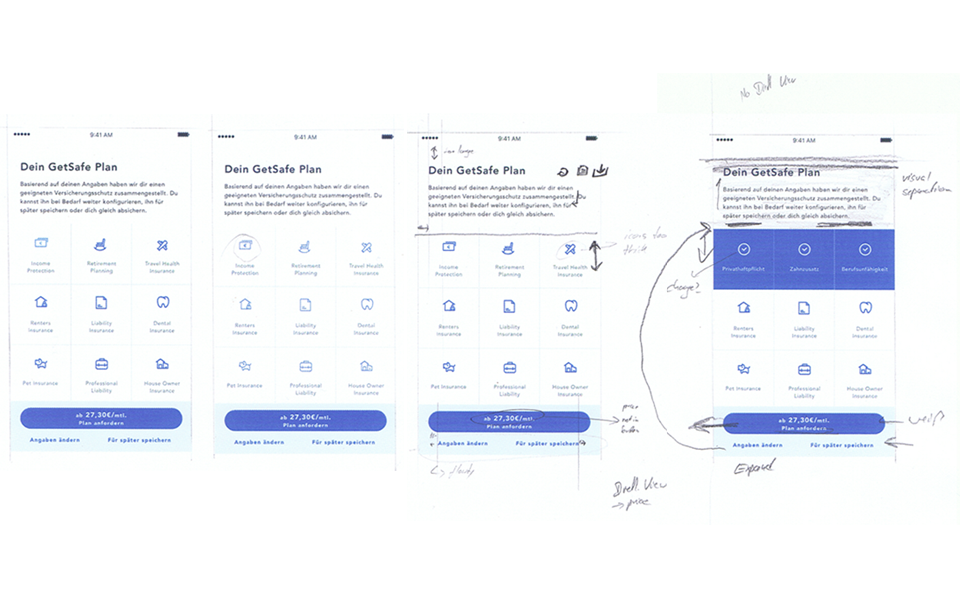

The result of the questionnaire would be a prioritised list of insurances, which would be individually assembled according to the personal needs of a user. It would group insurances into different categories of importance – “Absolutely Necessary”, “Recommended” and “You can think about it”.

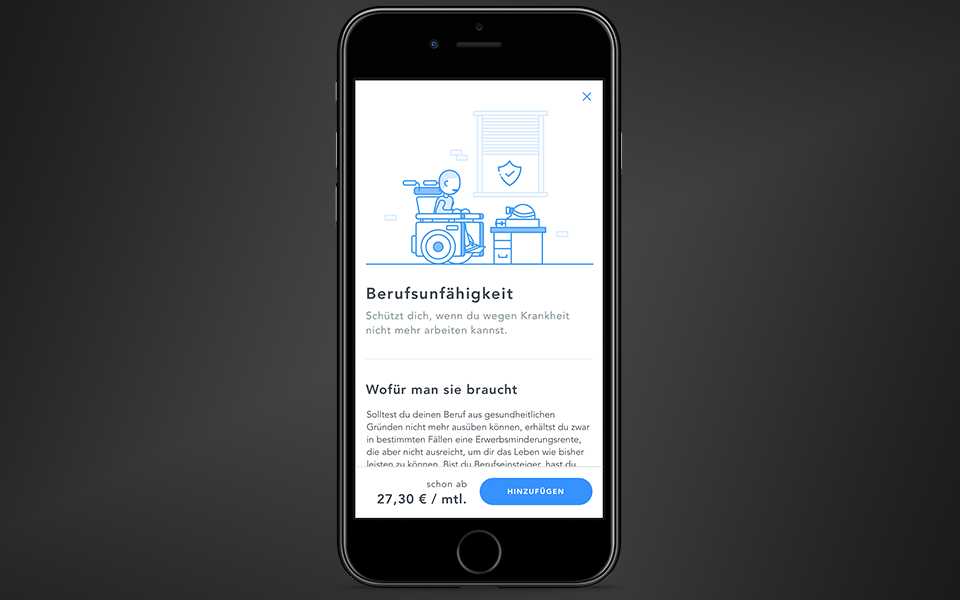

The categorisation should help the users from our target group, to make sure that they cover their most urgent needs. But it also allowed them to start on their long-term coverage, if they would want to. Explanations for every insurance give additional information about the domain and real life use case examples to provide context to the abstract constructs of insurances.

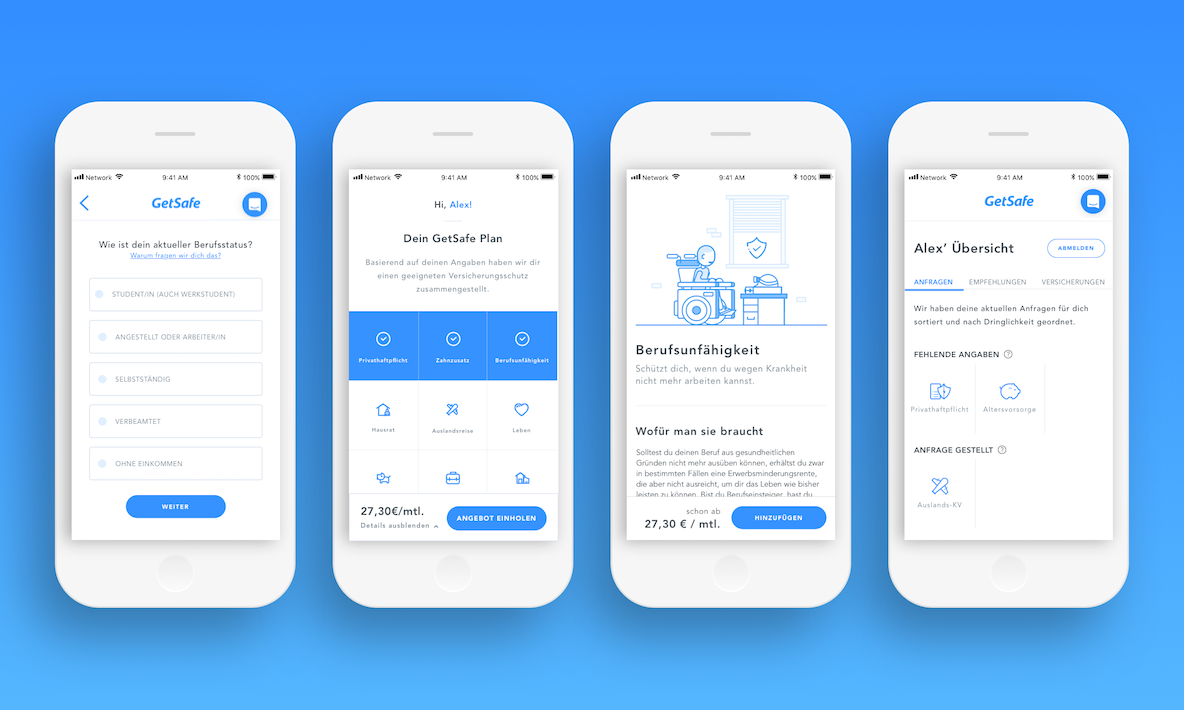

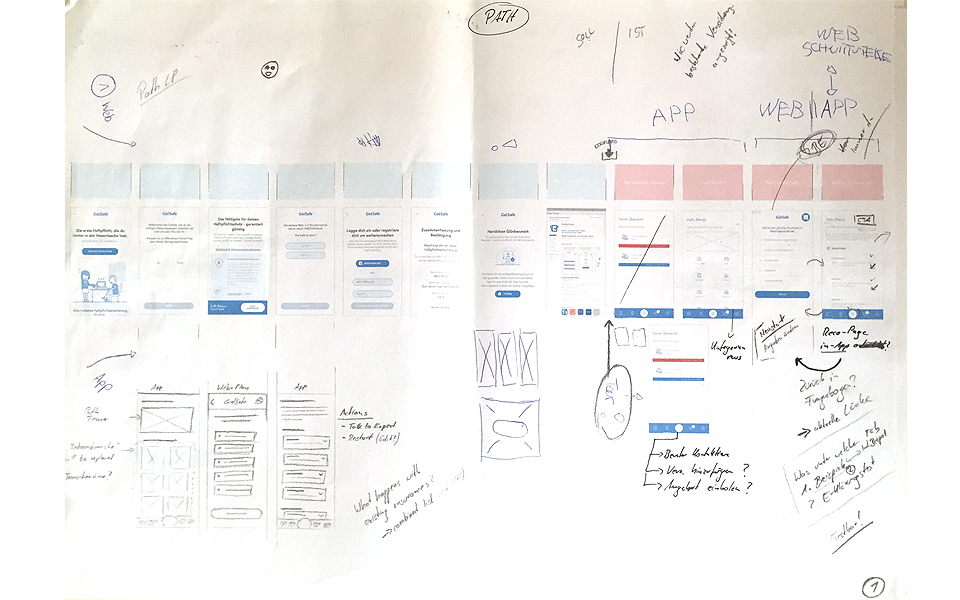

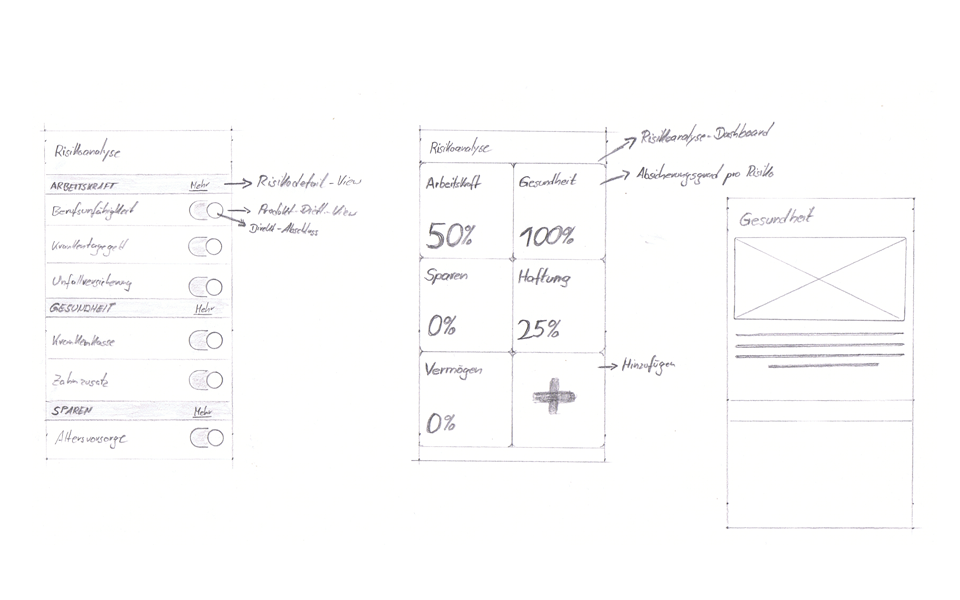

Prototyping & User Interface Design

We tested the questionnaire and the associated recommendation logic with users from our target group as well as our subject matter experts. The testing happened in various ways. The usability and the interaction design was tested with an Axure prototype and the recommendation logic was tested separately with a coded prototype.

We took the feedback that we got and adjusted the questionnaire and recommendation logic accordingly. Once we were certain that the service was in a stable state, we released the feature to pre-defined test group to learn from a broader audience. This was our minimum viable product (MVP). With the MVP we were able to test the feature and the associated assumptions in the real world. After having created the recommendation list, the actual insurance buying flow was a manual process. Users would need to get in touch with our advisors, if they wanted to buy any insurance they got recommended.

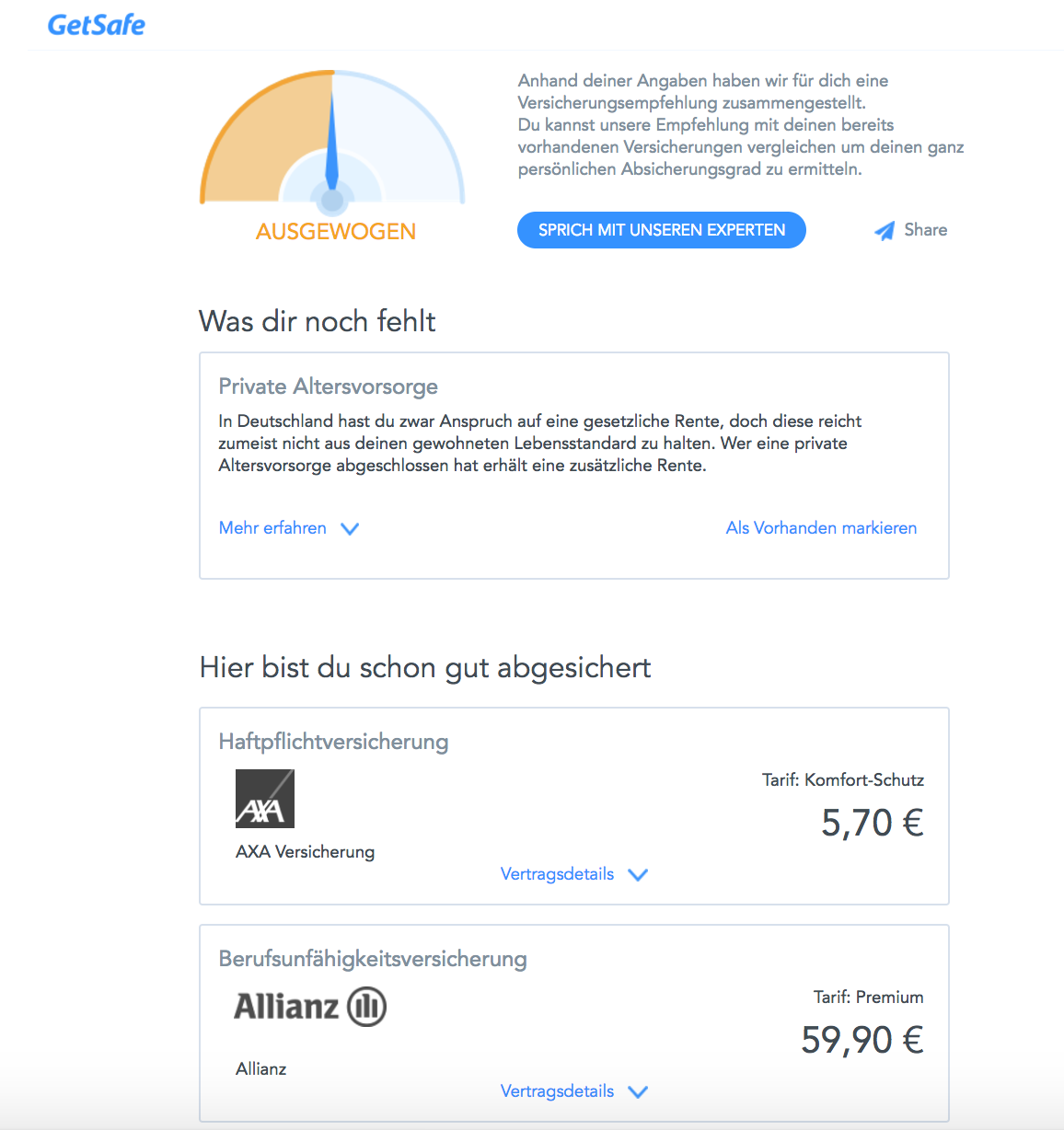

Based on the feedback that we gathered, we validated our assumption that helping people to identify their insurance needs was actually valuable for them. Based on the insights and feedback from our users, we were assured about moving on to the next part of the project. It became apparent, that users would not only want to discover their needs, but also want to satisfy them. Basically a one-stop shop for their insurance concerns.

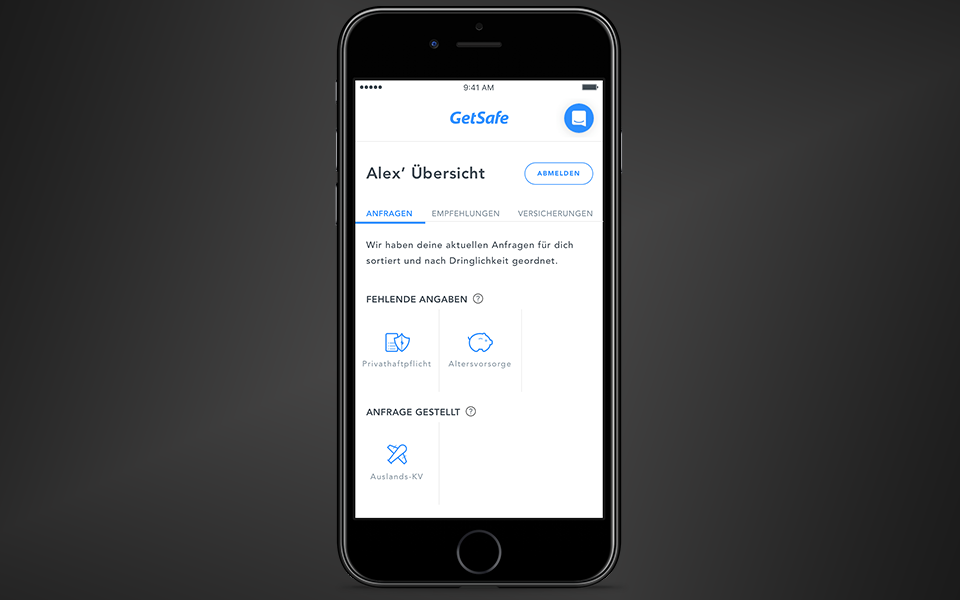

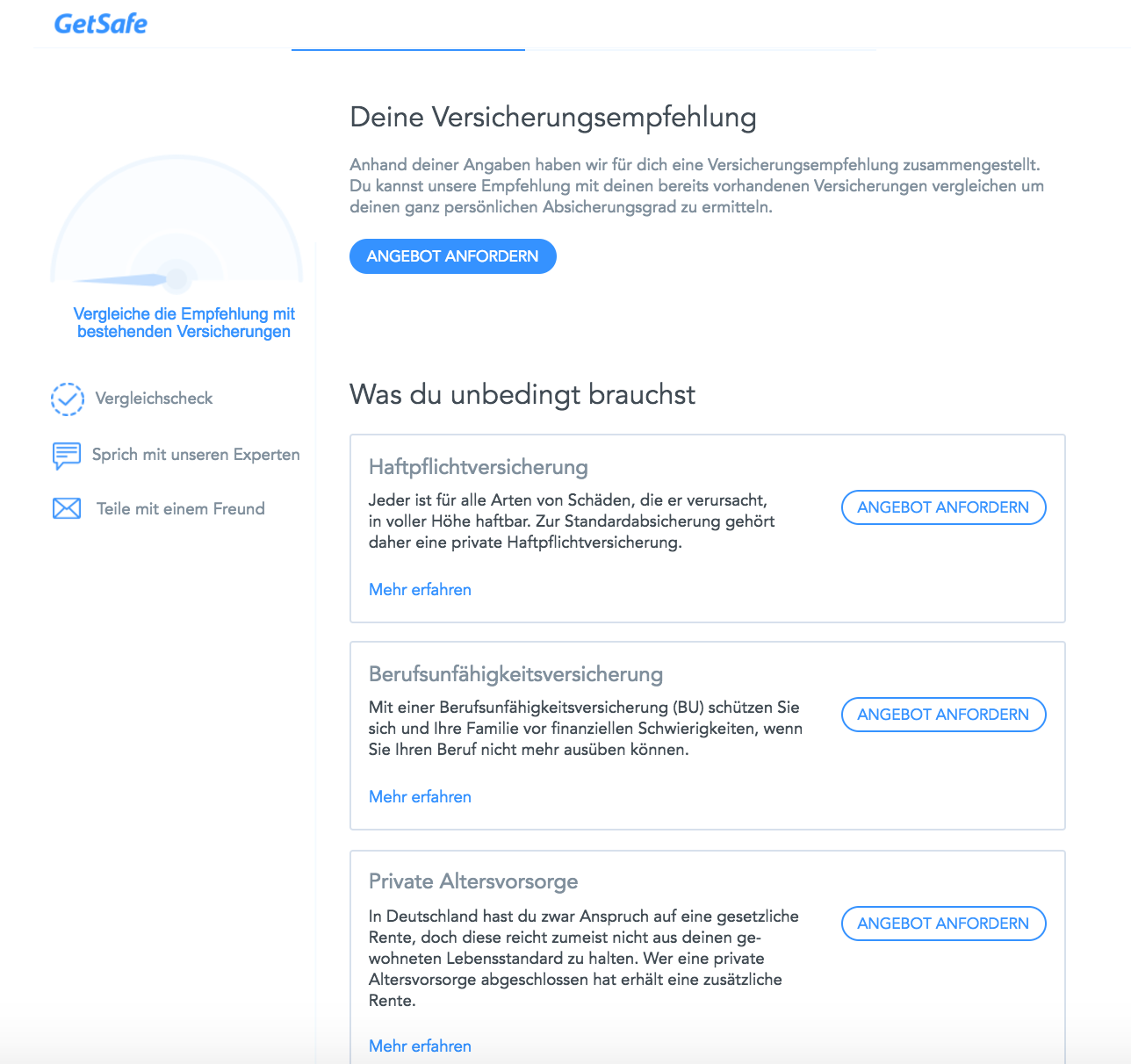

Therefore the second part of the project was to allow users to create inquiries for insurances with an automated process. Also, this service should integrate into the already existing GetSafe environment of being an insurance wallet.

Based on the foundational concept work, we’ve created a myriad of prototypes, layouts and user interface concepts to create a seamless buying and managing experience. Users would be able to discover their insurance needs, create inquiries for the insurances they want and manage them within the existing ecosystem. Another enhancement based on user feedback was, that we added elucidations about why we recommended an insurance for this particular users life situation. This should help users to better understand, why an insurance might or might not be needed.